By

means of this service, the investor may go into the agricultural

business in a reliable way, apart from his knowledge on the

matter and without the need of having either time or organization.

Investments may be in farming or in lands.

IN

FARMING (Grain production )

The investor-supplied funds are used to sow (soybean, corn and

wheat ) on household lands in the Argentinian nucleus area.

( see sowing area ) .

There are no limits to the amounts of money to be invested,

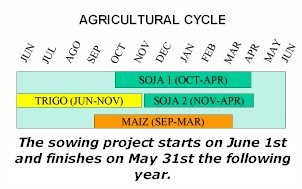

but there are time limits due to the crop cycle. ( at least

6 months ).

The agricultural business is quite a very good choice both to

protect capital and to get a reasonable return at the same time;

because, going into this business implies to position oneself

when putting the goods (soybean or corn) in a market with international

prices; that is, the investor is protected against inflation

in Argentina and in the USA as well.

As far as productive and climatic risks, they are reduced by

means of the running of the crops and the geographic diversification

respectively.

|

Soybean

1

|

(October-

April)

|

|

Wheat

|

(June-November)

|

|

Soybean

2

|

(November-April)

|

|

Corn

|

(September-March)

|

IN

LANDS (Land Purchase)

This service is composed of two independent parts. The first

part includes all that is related to the research and the advice

about investment based on the requirements and objectives of

the investor.

The second part is related to the management of the land with

the aim of maximizing the obtainable return by giving the land

on lease to a producer, by contributing with it to a productive

society or by running the direct exploitation.

return

The annual return of the land tenancy is comparable to that

of any other financial asset. The return is composed of two parts.

The first one is related to the productive farming of the land,

either as a result of the production or as that of the tenancy

if the field is given on lease to a producer. The second one

represents the increase in the value of the land in the ordinary

course of time.

This part of the return may be very important if the estate operations

are duly carried out according to the market conditions.

LOW RISK

Investment in lands is very safe. The investor is not only

protected against the global and domestic economic changes,

but also against every type of contingency that might arise

( for instance, terrorism, wars ) and that might affect the

economy and its subsequent repercussions on the price of shares,

bonds and any other asset of that type.

HIGH LIQUIDITY

Lands are a liquid asset. They can be sold quickly at any

time of the year, without changes in the property market value.

The time for the buying-selling depends basically on the market

conditions.

(NOTE: The estimated prices for the land return could be 4 % on

the lease to a producer and 3 % for the increase in the values

according to the historic average value of the land in the Argentinian

nucleus area. )